New Money in an Integral Economy: From Economic Feudalism to Economic Democracy

The Problem: Increased Wealth Inequality, Financial Bubbles, Inflation

Wealth inequality, financial bubbles, hyperinflation, and economic collapses are tied to current methods of printing and distributing new money. Millions of people have suffered terrible plights as a result of the mismanagement of new money, both in developed and less-developed countries.

“In early 1922, 160 German marks was equivalent to one US dollar. By November of 1923, the currency would depreciate to 4,200,000,000,000 marks to one US dollar.”1https://www.spurlock.illinois.edu/blog/p/1920s-hyperinflation-in/283 The stock market crash and the run on the banks impoverished millions of Americans in the 1930s. The collapse of the Russian Ruble in 1991 forced pensioners on fixed, now worthless, incomes to sell their lifelong possessions to survive. Hyperinflation reached 10,000 percent in Zaire in 1994. The announced $700 billion US TARP (Troubled Asset Relief Program) bailout had put liability of $16.8 trillion on the American government and its taxpayers by 2015.2https://www.forbes.com/sites/mikecollins/2015/07/14/the-big-bank-bailout/?sh=3fa8b6832d83 Then there is Venezuela. In October 2021, it took seven million Bolivars to buy a loaf of bread and Venezuela dropped six zeros off the Bolivar note. But this was not the first time: five zeros were cut in 2018, and three zeros in 2008. That is a total of 14 zeros. Tens of trillions of old Bolivars are required for a loaf of bread today.3https://www.aljazeera.com/economy/2021/10/1/venezuela-introduces-new-currency-drops-six-zeros

It may not be obvious that the hyperinflations of Germany, Zaire, and Venezuela are rooted in the same problems as the Great Depression, the TARP bailout, and current worries about the collapse of central banks in many countries. But they have one thing in common: centralized control and corruption related to the creation of new fiat money by governments and banks.

Today most economies are based on fiat money. Fiat money, a printed dollar bill, for example, has no actual value but is used as a medium of exchange based on faith that all people who use it recognize it as a legitimate means of exchange. Some people view fiat money as money created out of thin air, but this is not always the case. In conditions of hyperinflation, money is largely created out of thin air and largely worthless because the money supply does not represent the value of the real economy. The value of money, as a medium of exchange, is governed by the laws of supply and demand. When the money supply represents the value of the goods and services in an entire economy at a stable rate, there will be no inflation. If it takes a dollar to buy a loaf of bread in one year and the money supply is tied to the size of the economy, the same dollar might buy a loaf of bread 100 years later.

Some people argue that money itself should have value, for example, be made of a precious metal like gold or silver. However, this has not created stable economies either, for the value of precious metals is tied to its own law of supply and demand and not the growth of an economy. In a productive economy, the growth of goods and services outstrips the new discoveries of gold and silver. Fiat money can be used, but it must be tied to the growth of the economy to be stable. This requires tying the creation of new money to real economic growth. Both the American and Chinese economies have grown dramatically with the use of fiat money. The difficulty has been controlling inflation and preventing the increased concentration of wealth.

The concentration of wealth in the hands of large banks and Wall Street investment firms, the “1%,” is a result of the way new money enters the system. Banks create new money through lending and then are the beneficiaries of the interest on this new money. If debts are foreclosed, banks acquire the assets. If a government borrows money from a bank, rather than raising money through taxes, the fiat money created does not usually generate increased wealth through production, generating inflation. The current system of money creation is a form of Ponzi scheme that leads to bubbles and collapse for which the hard-working middle and lower classes suffer through no fault of their own.

Some of the problems that brought about the Great Recession and bank failure in the 1930s in the United States were largely corrected by the Glass-Steagall Act, which limited banks to banking and forbade speculating with other people’s investments. This Act remained in place and provided a proper bank governance system for over 60 years until it was repealed by the Gramm-Leach-Bliley Act in 1999 through the bank lobbying for a CitiBank-Travelers merger, who convinced both the Republican Congress, led by Newt Gingrich, and the Democrat President, Bill Clinton to abandon this bank regulation. Bank gambling and corruption were immediate. The Enron and WorldCom scandals occurred in just two years and by 2007 the entire system collapsed as banks created a financial house of cards based on speculation, risky loans, derivatives, credit swaps, and other financial instruments unrelated to sound banking or economic growth.

While proper regulation of banks is important, there is a systemic problem with the way banks create new money through fractional reserve lending. This method of money creation gives commercial banks, but not individual citizens, the opportunity to fund new economic growth through lending. But this new fiat money should belong to the entire economy, and not just the bankers. This system is a form of economic feudalism, analogous to the political feudalism in the Middle Ages, where all citizens served political rulers rather than being free to pursue their own ends. A democratic vote, republican representation, and checks and balances on power remove the power from the political leaders, who become servants of the people rather than tyrants and dictators. A similar transformation can occur in the economic sphere with each citizen having an equal say in the spending of new money, rather than bankers who inevitably use their economic power for themselves.

This article proposes the creation of economic democracy that is as evolutionary in the economic sphere as modern liberal democracy in the political sphere. In an integral society, this means the evolution of the economic sphere catching up with the evolution of the political sphere: moving from feudalism to freedom and equal opportunity.

Before discussing a solution, we first have to look into the problem of the current feudalistic economic system in practice in much of the world.

The Source of the Problem: New Debt-Created Money by Banks

The earliest form of banking is charging a fee for the storage of money for safekeeping. These are called banks of deposit. Banks were not allowed to use this money for lending or speculation because it was not theirs. It had to be kept in a vault until the owner wanted it back. The lending of money was a different business. A moneylender would lend his own money, which would be repaid-with interest. These simple financial services did not involve the creation of money that in antiquity was often gold or silver coins.

Anytime someone is sitting next to a pile of money that belongs to someone else, there is a temptation to use it for one’s own purposes if one does not get caught. This is true of both bankers and government officials responsible for tax money. In the Middle Ages when modern banking was born, bankers would use some of the money they were storing for depositors for lending or other enterprises, trying to make extra wealth off of the money they were storing. In 1361, to prevent such corruption, the Venetian Senate passed a law that made this illegal. Over time bankers were cheating again and in 1524 a board of bank examiners was created for the public inspection of banks to make sure all the deposits were in storage.

Bank inspectors must have been lax or corrupted, because in 1584 the largest bank, the house of Pisano and Tiepolo, failed when it was unable to pay depositors from reserves. The government then created a state bank that was not allowed to earn money in any other way than fees for services: coin storage, currency exchange fees, transfers of payments between customers, and notary signatures.4John Kenneth Galbraith, Money: Whence It Came, Where It Went (Princeton University Press, 2017, first published 1976), p. 19. This created honest banking.

Unfortunately, people running state banks are no less greedy than people running private banks. By 1619, the lobbyists for a new state bank convinced the Senate it could get a lot of money if it created a bank that could issue credit. Fiat money was created out of nothing and lent to the government. This became lucrative for bankers and government officials in collusion, while the taxpayers were responsible for the government debt.

In 1609 the Bank of Amsterdam was created on the sound principle that it was only allowed to charge fees for services not issue loans. It issued paper currency backed by coins stored in the bank. The City Council had to take an oath that the bank reserves remained intact. Eventually, the bank succumbed to temptation, first allowing depositors to overdraw their accounts–creating fiat money–and then secretly lending to the Dutch East India Company. When the truth came out, people demanded their deposits, and the bank was declared insolvent. The Bank of Hamburg, from 1619 until captured by Napoleon in 1813 is the best example of an honest bank. It remained uncorrupt for nearly 200 years.

The Bank of England, chartered in 1694, was the first modern central bank that became a permanent cabal between bankers and politicians. The banks were able to create fiat money and earn 8% interest on loans to the government. The government was able to have handy access to this money to finance wars and other political goals without an upfront tax on citizens. Like other fiat-created bank bubbles, there was inflation of 100% in two years and a run on the bank that should have caused the bankruptcy. Instead of declaring bankruptcy, and liquidating the bank’s assets to satisfy creditors, the Parliament was convinced to intervene and “suspend payment in specie.”5https://seekingalpha.com/instablog/25783813-peter-palms/4549696-history-of-fractional-reserve-banking-which-became-model-for-federal-reserve-system-unbroken This was the first instance of a bank declared “too big to fail” because the elite bank cartels had government protection when the governments learned they too could profit at the expense of the citizens, who lost their personal investments to that invisible tax known as inflation.

David Ricardo proposed the best fix for this inflationary fiat system was to require money to be backed by assets. He did not think precious metals were a perfect way to back notes, but that “They are, however, the best with which we are acquainted.”6David Ricardo, The Works and Correspondence of David Ricardo: Pamphlets 1815- 1823, Piero Sraffa, ed. (Cambridge: Cambridge University Press, 1951), Vol. IV, p.58-62.

Most modern countries have followed this banking model, either with government or private central banks. Sometimes backed by gold, but increasingly not. In the US, even though notes being “redeemable in gold or silver” was dropped by President Nixon in 1971, repeating the pattern of protectionism set by Parliament in May 1696, hyperinflation did not immediately follow. This was likely due to the bank regulations established in the 1930s with the Glass-Steagall Act and the FDIC. The abolition of the Glass-Steagall Act by both political parties in 1999 removed this regulation and by 2007, the American Banks had become “too big to fail.” The corrupt banks were bailed out, rather than the Glass-Steagall Act being re-imposed as former Fed Chairman Paul Volker recommended:

The New York Times today has an article about former Federal Reserve Chairman Paul Volcker’s crusade to bring back the Glass-Steagall Act. Obama isn’t listening. The Act used to keep separate commercial and investment banking activities. The Gramm-Leach-Bliley Act of 1999 repealed it. Consequently “full service” banking behemoths like Citigroup and JP Morgan came to be, now allowed to participate in every financial activity imaginable. Many, including Volcker, believe this was a big mistake, and one of the causes of the financial crisis. I don’t see it. At all.

The Atlantic, October 21, 20097The Atlantic, October 21, 2009. https://www.theatlantic.com/business/archive/2009/10/volckers-quest-to-reinstate-glass-steagall/28759/

The above quote in The Atlantic was written as a defense of the cabal which continued to get government protection, writing hollow legislation like the Sarbanes-Oxley Act and the Dodd-Frank Act, which were smokescreens that enabled the biggest financial firms to continue at the expense of the smaller firms. A number of monetary experts like Ron Paul on the right began arguing to “end the Fed” or return to the gold standard, and the leftist Occupy Wall Street Movement began a sit-in around Zuccotti Park in lower Manhattan on September 17, 20118https://www.history.com/this-day-in-history/occupy-wall-street-begins-zuccotti-park protesting the income inequality the corrupt system was producing.

The private Western central banks continued to print money, and trade derivatives, credit swaps, adjustable-rate mortgages, and other risky investments. They managed to avoid inflation by driving interest rates to zero until they created large amounts of fiat money, blaming the Covid Crisis in 2020 and the Ukraine War in 2022. This caused rapid inflation and visible banking system problems to the general public.

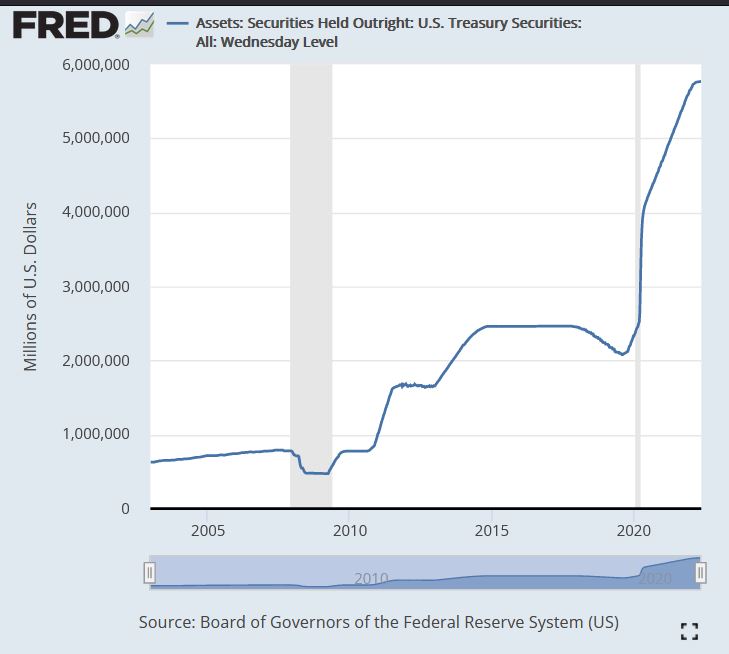

The US Treasury Note Bubble, shown in Figure 1 above,9https://fred.stlouisfed.org/series/TREAST indicates the US financial system is today in a far more serious bubble than before the relatively mild collapse in 2008 that led to the big bank bailout. This is due to the failure of the government legislators benefitting from the corrupt money system to step in on behalf of the citizens and curtail the banks and government spending.

The history of banking for the last 500 years confirms that the creation of new fiat money by banks or the government, injected through debt financing, causes elites to profit from this system until greed that causes excessive money creation leads to bubbles, inflation, and collapse. Inevitably the citizens, who have worked hard, borrowed, and saved, pay the price as they lose their assets to the money creators and their savings through inflation.

Honest Banking in an Integral Society

Honest banking can include many traditional banking services, but should not involve new money creation. Banking should be an “old money” business. Banks can store money and valuables for customers for a fee. This earliest role of a bank could be considered a secure building with deposit boxes in a vault. Banks can also act as moneylenders who lend their own money and profit from the interest. Banks can also serve as brokers, lending out depositors’ money for interest and splitting the return with depositors. Because there is a risk to the depositors that some loans may fail, insurance on the deposits has proven important for this type of banking.

In a normal savings and loan banking market, where all activities are based on old money, the laws of supply and demand govern interest rates because there is no central bank or government intervention. Traditionally, this rate will be 5-6% for home mortgages, with banks and depositors receiving 2-3% each. The amount will be higher for corporate loans, because there may be less collateral available in the case of bankruptcy. There are no huge fluctuations of interest the government acts as a referee, not a player. There is no theft or swindling through inflation caused by old-money banking. Honest banking does not require huge taxpayer bailouts or destroy an entire economy when a single small bank fails.

Marxism: a Retrograde Proposal

Communists and the Occupy Wall Street movement on the left complain about this wealth inequality and are popular among young idealists who want to see a fair economy. Occupy Wall Street had no solution, and communists advocate a worse solution–a centralized economy run by a political party and politicians. Communism advocates the seizure of ownership of “private property” and putting it in the hands of a working-class government.10“Private property, to a communist, is not your shoes or toothbrush, or even your house.

Those things are called personal property and under socialism and under communism they continue to belong to workers in much the same manner as they do now.

When Marxists speak of private property under capitalism, it refers to the tools of production that should be owned by all of society, such as factories, lands, stores, mines, and all those things that are gifts of nature or are built by many people over many centuries, but are now being monopolized by a few….

In the struggle to secure personal property — the necessities and comforts of life — the working class will find it necessary to overthrow the institution of private property and put all the means of production under the control of a workers’ government. https://www.workers.org/private-property/

The current goal of the international workers’ party is to increase ownership of “personal property,” such as houses, televisions, smartphones, and the necessities of life. But it falsely declares that government-run industries will be more innovative and productive than a market-driven economy. Placing the “collective” ownership of all “private property” in the hands of a workers’ party takes the ownership away from the banks but provides no incentive for the people to produce anything. The Russian Revolution proved this by instead of creating a utopia, it created a new form of serfdom and often used slave labor for production. Communist leaders fail to understand the innate desire of people to be free to pursue their own life, liberty, and happiness and not that of communist bosses. It is an obvious conflict of interest for a party to advocate it should own all the private property. It simply substitutes a new set of elites for those they call capitalists.

Recently, the World Economic Forum, in its push for The Great Reset, has advocated an even greater lie with the catchphrase, “own nothing and be happy.”11https://www.forbes.com/sites/worldeconomicforum/2016/11/10/shopping-i-cant-really-remember-what-that-is-or-how-differently-well-live-in-2030/12https://m.facebook.com/watch/?v=10153920524981479&_rdr They do not want people to own their own homes. This forum is based on an even greater concentrated capitalism run by Wall Street investment funds with ties to the Chinese Communist Party. Adam Yang’s idea of “Universal Basic Income” exemplifies how such a system might create an entire class of dependents and serfs in a new industrial feudalism. This might parallel the agrarian feudalism that followed to collapse of the Roman Empire and the disappearance of the middle class.

A Solution: Credit Distributed New Money Creation

“Owning nothing” really means you will be owned by elites. “Own or be Owned” is the proposed title for a new book by Norman Kurland, President of the Center for Economic and Social Justice (CESJ). Dr. Kurland and CESJ propose a “third way,” which is neither the current system of new money creation nor some form of communism/feudalism. This is a more democratic system of wealth generation. All new money would enter the “capital homestead accounts” of all citizens rather than being created by banks in fractional reserve banking. This would give everyone the opportunity to act as individual investment banks, democratizing the wealth concentrated in the hands of a few economic and political elites. Everyone in the society would have equal access to capital that can provide personal economic sovereignty.

Kurland’s ideas do not require “seizing of the means of industrial production” or taking anything that people already have. Instead, it transfers the ownership of new money from banks to individual citizens. Instead of the government owning the means of production and allocating portions to citizens, all citizens would democratically own the means of production and become the autonomous citizens required to govern the government. CESJ has proposed an Economic Democracy Act to implement this system of wealth creation and distribution.

Capital IRAs

I am proposing a simpler way that does not create new money through debt financing. New money would enter the economy as credit rather than debt. All new money would be distributed equally to all citizens’ capital investment IRAs. These IRAs would not receive new money to be spent by consumers or lent to borrowers. Rather, it would need to be invested in stocks or mutual funds, providing working capital for new or existing C Corporations to produce more goods and services. Every citizen would have an opportunity to “vote” with this money in the creation of their own financial future. This system would induce the development of an economic culture of production and entrepreneurship, rather than one of secret strategizing for maximum gain at others’ expense in Wall Street investment bank boardrooms.

Capital IRA’s could serve three functions (1) motivating everyone to invest in productive activity for a healthier economy, (2) assistance in attaining personal economic sovereignty by using profits on the principal in the capital account, and (3) having a pension fund for retirement by drawing out principal in the fund beginning at age 65. At retirement, individuals would no longer receive deposits of new money. Withdrawals of the principal in the capital IRA would be prorated so that it would be depleted at age 100. Since most people die before reaching 100, the balance of the capital fund could be transferred to the county of their residence and be used for welfare, education, or health care.

New Money Calculated like Stable Coin

To prevent inflation and bubbles, “new money” would be calculated each year based on the growth in value of the entire economy. For example, if an economy grew by 4 trillion dollars and served 400 million citizens, a principal of 10,000 would be deposited into each person’s capital IRA. If the economy did not grow, no money would be deposited. However, the likelihood of this happening would be small because these personal investors would have the type of motivation that investment banks have to work hard at making money. This would still be fiat money, but it would be divided among everyone equally. In order to avoid inflation and keep the value of currency constant, calculations would need to be made along the line of cryptocurrency “stable coins” that tie the money supply to the value of an economy not related to debt. The problem with current “stable coins” is that those who currently introduce such coins, like central banks, do not distribute the new coin value to everyone, but use it for themselves the way the big banks and governments exploit the current system.

Capital IRAs could replace Social Security

Individual capital IRAs would (1) guarantee every citizen an equal share in economic opportunity by investing their credit as shares in corporate enterprises—either big thriving companies like Apple or local startups that they run. The risk would be their own, and no individual would be “too big to fail.” Everyone would have opportunity and risk, but this would create a culture based on productivity and responsibility rather than dependence and theft. It would help create better and happier citizens–which should be the main goal of society.

New money capital IRAs would generally not end normal employment for most people, especially if they invested securely with a broker in mutual funds and A-rated firms. As with other investment portfolios, some will perform better than others. Investing in new local ventures might be riskier but more rewarding, and some of the original principal could be lost leading to a smaller pension from that account. People could have other investment funds or annuities based on “old money” they earn as wage labor just as they do now and consider the capital IRA as a supplement if the national economy did not grow much.

Capital IRAs described in this proposal do not guarantee a fixed income like annuities or social security. However, at recent rates of growth in the US of $10,000 per year per person, this would be $650,000, or $18,500 per year if no principal was lost through bad investing. Current median social security payments in the US are $19,370 per year. However, because the corruption and inflation bubbles caused by corrupted new money creation never invested in production (and often used for the seizure of other’s assets), the is likely that production would significantly increase in this integral economy–giving individual investors more new money, in addition to dividends paid on shares.

The American Dream and Marx’s Fading Away of the State

It is very easy to imagine over 90% of the population retiring with one million dollars or more in their capital IRAs as wealth would be widely distributed among all citizens. This would decrease growing wealth inequality and create a large prosperous middle class. One could see this as a realization of some of Karl Marx’s hopes as well: ownership of the means of production by all, and a fading away of the state13Edgar Hardcastle, The Withering away of the State: From Marx to Stalin—or at least removing payment of most entitlements from the state (51% of the US budget in 2019). Achieving such economic democracy cannot happen by giving ownership to the state, as we have learned from the failure of communism. Rather, it is achieved by giving investment power to all citizens, who as John Locke (1632-1704) argued, have a right to life, liberty, and property.

Thank you for providing a quick survey of banking and its tortured history. My key takeaway is the point made about the need for Economic Democracy to match and support Political Democracy. If we want to hold onto freedom and individual sovereignty, there is no alternative. This means systemic reform of the money and banking system. Mortimer Adler and Louis Kelso in their book, Capitalist Manifesto, (1958) made this point (Everyone should at least read the preface!). Finding the way to create true economic democracy should be the lodestar for serious leaders on both sides of the aisle to lead us away from the darkness of authoritarianism and failed ideas – the Great Reset included! Kudos to the work of the Center for Economic and Social Justice and to your innovative ideas presented here. Details can be debated but let us lift up this VISION and get to work making it happen. There is no time to waste.