Individual sovereignty is a prerequisite of an integral society. Integral society begins with people who have an integral consciousness that transcends the self, respects the rights of others, and understands the nature of social institutions in a complex integral society. Individual sovereignty, nurtured by the Protestant reformation and significantly on display in early American society, reveals self-responsibility, self-direction, and self-sufficiency. Such people do not need to rely on the patronage of feudal lords or governments. Such people can sustain democracy by designing good laws and governance structures and supporting them financially.

These social conditions existed widely at the time of the US founding. While there were wealthy aristocrats and slaves comprising 25% of the population in 1790, the majority of people were self-sufficient farmers, tradesmen, and businessmen. These people had personal sovereignty and provided the demographic basis for democracy. It was this group of people who pushed to abolish slavery.

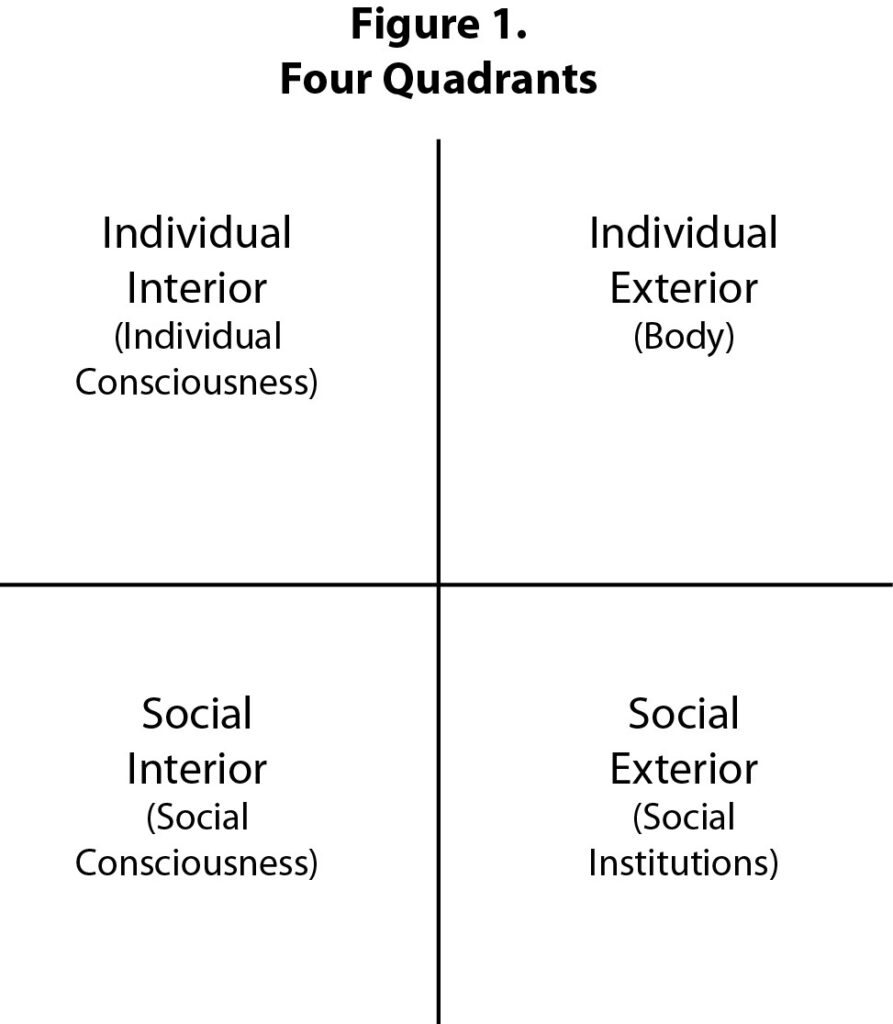

Individual sovereignty refers to self-ownership. In the cultural sphere, this means ownership of one’s conscience, ideas, words, and behavior. In the governance sphere, this means ownership of one’s life and body. In the economic sphere, this means ownership of property. While the middle-class is often discussed in terms of annual income, self-sufficiency is a better indicator of individual sovereignty, as people on farms raising their own food need less cash than people in cities.

The legal foundation for personal sovereignty is the right to life, liberty, and property. This was stated by John Locke in his Second Treatise on Government, written between 1679 and 1689 The United States Declaration of Independence (1776) declared “Life, Liberty, and the Pursuit of Happiness” as the foundation for a free society. However, the right to “property” was clearly stated in the 5th Amendment to the US Constitution:

…nor shall any person … be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.

Amendement 5, Section 1

The US Constitution only provides the opportunity for personal sovereignty. Just having a right does not make one a sovereign. Personal sovereignty requires responsibility, knowledge, and skills that can make the legal opportunity real. Parents, schools, and communities can help nurture those requisites, but they can’t make one successful. Each individual is ultimately accountable for their own life.

Continue reading →